These are only suggestions and ideas for you to discuss with a qualified insurance agent. Be sure you rely on an insurance agent you can trust, and don’t cheap out on the premiums or coverage.

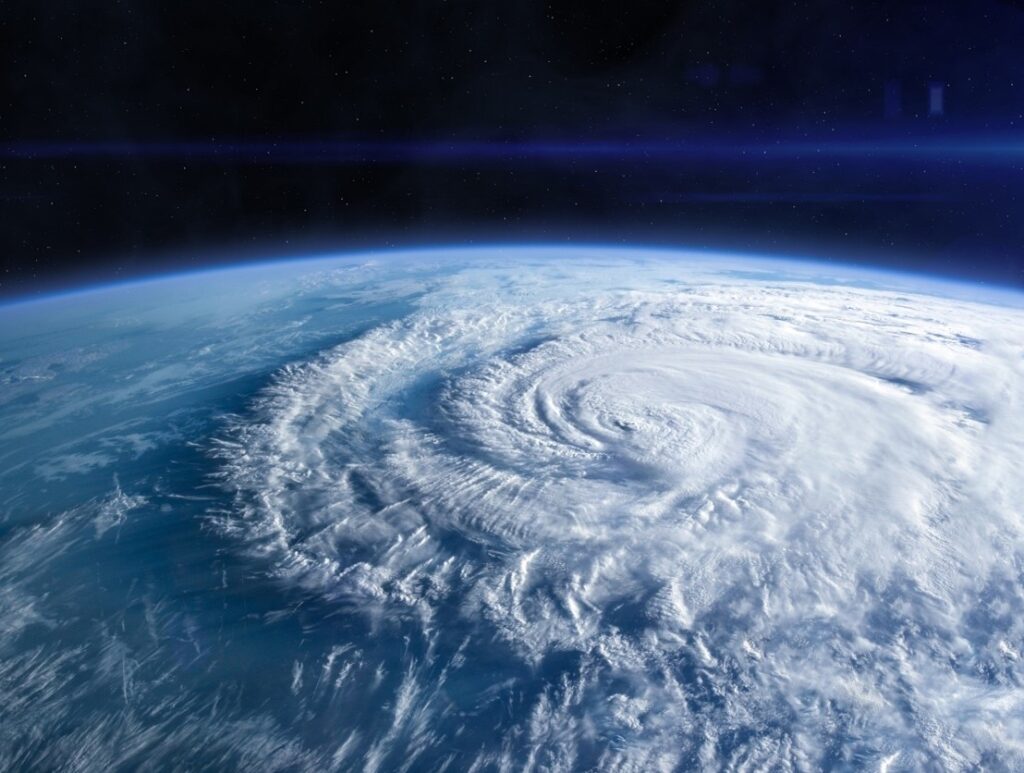

Living in a hurricane-prone region poses unique challenges and risks for property owners. With the potential for devastating wind damage, flooding, and other associated dangers, it’s crucial to have adequate insurance coverage to protect your property and financial well-being. In these risk-prone areas, standard homeowners’ insurance policies may not be sufficient to provide comprehensive protection against hurricane-related losses. Instead, specialized insurance options, such as hurricane policies and wind damage coverage, become essential components of a homeowner’s risk management strategy. Be sure to do your research and work with a skilled insurance agent.

One of the primary considerations for homeowners in hurricane-prone regions is securing coverage specifically designed to address the risks posed by these powerful storms. While standard homeowners’ insurance typically covers damage caused by windstorms, it may exclude or impose limitations on coverage for hurricane-related losses. This is where hurricane insurance comes into play. Even with hurricane coverage, expect your hurricane deductible to be more. (Sometimes it’s based on a percentage of the insured value of the property.

Hurricane insurance is a specialized type of coverage tailored to the unique hazards associated with hurricanes, including high winds, storm surges, and torrential rain. It can provide financial protection against a wide range of hurricane-related damage to your home, personal belongings, and other structures on your property. This can include structural damage to your home, as well as the cost of temporary accommodations if your home becomes uninhabitable due to hurricane damage.

In addition to hurricane insurance, homeowners in hurricane-prone regions may also need to consider windstorm coverage. While wind damage is often included in standard homeowners’ insurance policies, the extent of coverage can vary depending on the insurer and the specific terms of the policy. Remember: there are many different types of insurance policies, as well as different coverages. Windstorm coverage specifically addresses damage caused by strong winds, which are a common feature of hurricanes. This coverage can help offset the costs of repairing or replacing damaged roofs, windows, siding, pool screen cages, even vinyl fences and other elements of your home.

In some cases, homeowners may need to purchase separate flood insurance to protect against the risk of flooding associated with hurricanes. Standard homeowners’ insurance policies typically do not cover flood damage, including that caused by storm surges or overflowing rivers and streams. Flood insurance is available through the National Flood Insurance Program (NFIP) or private insurers and can provide coverage for both structural damage to your home and damage to your personal belongings.

When determining the appropriate insurance coverage for living in a hurricane zone, it’s essential to carefully review the terms and limitations of each policy. This includes understanding deductibles, coverage limits, and any exclusions that may apply. Please engage a professional, skilled insurance agent for this! Working with an experienced insurance agent can help ensure that you select the right combination of coverage options to adequately protect your home and assets against the risks posed by hurricanes.

It’s also important to regularly review and update your insurance coverage to account for changes in your property value, improvements or renovations to your home, and evolving risk factors. As hurricanes continue to increase in frequency and intensity, maintaining comprehensive insurance coverage is essential for homeowners in hurricane-prone regions to safeguard your financial security and peace of mind.

Living in a hurricane zone requires careful consideration of insurance options to adequately protect your home or commercial building and assets against the risks posed by these powerful storms. Hurricane insurance, windstorm coverage, and flood insurance are critical components of a comprehensive risk management strategy for property owners in hurricane-prone regions. By understanding the unique hazards associated with hurricanes and selecting appropriate insurance coverage, you can mitigate their financial exposure and ensure that they are prepared to weather the storm.

Author: Dick Wagner, Tactical Specialist